The Central Provident Fund (CPF) has long been a cornerstone of Singapore’s retirement planning system, with its Special Account (SA) playing a pivotal role in helping citizens save for their golden years. On January 19, 2025, a significant change is on the horizon: the CPF Special Account will be officially closed for members aged 55 and above. What does this mean for CPF members, and how can they adapt to this shift? Let’s explore.

Understanding the CPF Special Account Closure

The CPF Special Account has traditionally served as a vehicle for members to grow their retirement savings at attractive interest rates. However, as part of recent reforms aimed at streamlining CPF operations and improving efficiency, the government has announced its closure for members aged 55 and above. The funds in the SA will be integrated into the Retirement Account (RA) to simplify the retirement planning process.

Key details to note include:

- Closure Timing: The Special Account will be closed on 19th January 2025 for members aged 55 and above.

- Automatic Transfers: Upon closure, existing SA balances will be transferred to the RA, up to the Full Retirement Sum (FRS), which currently stands at $198,800. This will enhance monthly payouts. Any remaining SA savings beyond the FRS will be moved to the Ordinary Account (OA), which earns an interest rate of 2.5%, and can be withdrawn when needed.

- Continued Growth: Transferred funds will continue to earn interest, with RA balances benefiting from long-term rates (up to 4% for SA-equivalent funds), ensuring members’ savings remain robust.

Enhanced Retirement Sum (ERS) Update

As announced in Budget 2024, the Enhanced Retirement Sum (ERS) will be raised to $426,000 on 1 January 2025, from three to four times the Basic Retirement Sum (BRS). This change enables CPF members to enjoy higher retirement payouts if they voluntarily top up their RA to the ERS.

For example, if a male CPF member who turns age 55 in 2025 tops up his RA to the raised ERS of $426,000 in 2025, he can expect an increase in monthly payouts from $2,530 to $3,300 at age 65 under the CPF LIFE Standard Plan for as long as he lives.

The Impact on CPF Members

The closure of the Special Account has several implications:

- Streamlined Savings: Consolidation of accounts simplifies the management of retirement funds, making it easier for members to track and utilize their savings.

- Interest Rate Continuity: Members’ transferred balances will continue to grow under the Retirement Account’s competitive interest rates, maintaining the potential for substantial retirement income. The RA offers an interest rate of up to 4%, similar to the SA.

- Adjustment for Milestone Age: Members approaching or over the age of 55 will need to plan for the transition, understanding how the redistribution of funds affects their retirement strategy.

Highlighting Potential Loss of Interest

One significant implication of this transition is the reduction in interest rates for balances moved from the Special Account (4%) to the Ordinary Account (2.5%). Over time, this 1.5% difference in compounding interest can lead to substantial differences in accumulated savings.

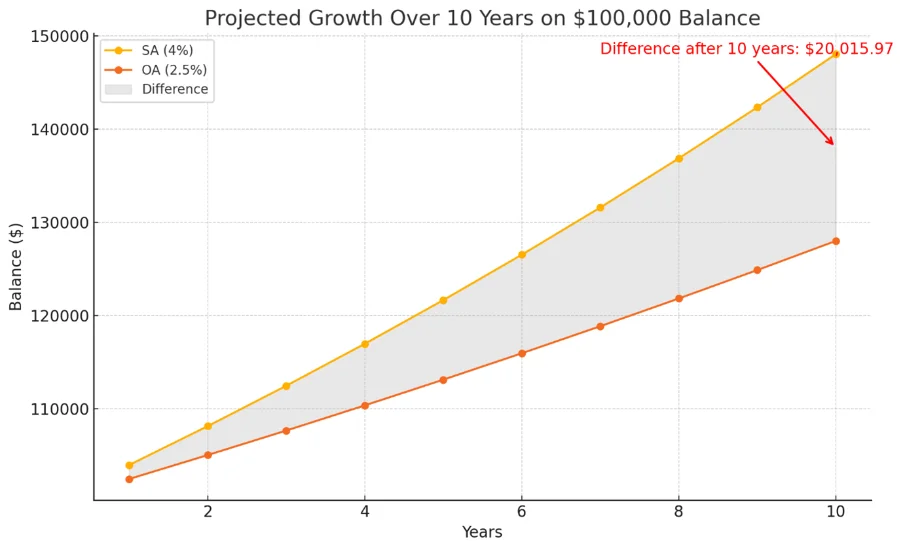

The chart below illustrates the projected growth of a $100,000 balance over 10 years at both interest rates. The shaded area highlights the cumulative loss in potential interest earnings due to the 1.5% reduction.

As seen in the chart, the difference amounts to approximately $21,486.68 after 10 years. This underscores the importance of understanding the implications of such changes and exploring ways to mitigate the impact on long-term retirement savings.

Options Available to Members

Despite these changes, CPF members have several pathways to safeguard and grow their retirement savings:

- Explore the Retirement Account: Familiarize yourself with the RA’s terms and benefits to maximize its potential for your retirement needs.

- Top-Up the CPF Ordinary Account: Consider voluntary contributions to the OA, which earns an interest rate of 2.5% and can also be utilized for retirement purposes, offering flexibility in fund usage.

- Utilize the CPF Investment Scheme (CPFIS): Members with a higher risk tolerance may explore investments in approved instruments through CPFIS to potentially enhance their retirement savings.

- Seek External Retirement Solutions: Complement CPF savings with private retirement plans or other financial instruments to diversify and strengthen your retirement portfolio.

Expert Recommendations

- Revisit Your Retirement Goals: With the changes, take the time to reevaluate your financial objectives and ensure they align with the new CPF structure, making adjustments as necessary.

- Consult Financial Advisors: Engage professionals to develop a strategy tailored to your unique circumstances, leveraging their expertise to optimize your retirement planning.

- Stay Updated: Keep an eye on CPF announcements and tools, such as the CPF planner, to make informed decisions and remain proactive in managing your retirement savings.

Conclusion

The closure of the CPF Special Account for members aged 55 and above marks a significant shift in Singapore’s retirement planning landscape. While it may present challenges, it also offers an opportunity for CPF members to streamline their savings and explore new strategies. By staying informed and proactive, you can ensure your retirement plans remain robust and aligned with your financial goals.